The 3-Minute Rule for Stonewell Bookkeeping

The 25-Second Trick For Stonewell Bookkeeping

Table of ContentsSome Known Questions About Stonewell Bookkeeping.Examine This Report about Stonewell Bookkeeping8 Easy Facts About Stonewell Bookkeeping ExplainedFacts About Stonewell Bookkeeping Uncovered7 Simple Techniques For Stonewell Bookkeeping

Here, we address the concern, exactly how does bookkeeping help a business? In a sense, audit books stand for a photo in time, however just if they are upgraded often.

None of these conclusions are made in a vacuum cleaner as accurate numeric information have to copyright the monetary choices of every tiny organization. Such data is assembled via accounting.

You know the funds that are readily available and where they drop short. The news is not always good, yet at least you know it.

Some Known Details About Stonewell Bookkeeping

The maze of reductions, debts, exemptions, schedules, and, of training course, fines, is adequate to just give up to the internal revenue service, without a body of well-organized documentation to sustain your cases. This is why a specialized accountant is vital to a little service and is worth his/her king's ransom.

Those philanthropic contributions are all specified and gone along with by info on the charity and its payment info. Having this info in order and close at hand lets you submit your income tax return with convenience. Remember, the federal government doesn't mess around when it's time to submit tax obligations. To be sure, a company can do whatever right and still go through an internal revenue service audit, as numerous already know.

Your service return makes claims and depictions and the audit targets at confirming them (https://fliphtml5.com/homepage/hirestonewell/hirestonewell/). Excellent bookkeeping is everything about attaching the dots in between those representations and reality (business tax filing services). When auditors can follow the Learn More Here details on a journal to invoices, financial institution declarations, and pay stubs, among others papers, they rapidly learn of the expertise and integrity of business organization

The Ultimate Guide To Stonewell Bookkeeping

In the very same method, haphazard accounting adds to anxiety and anxiety, it additionally blinds local business owner's to the possible they can recognize over time. Without the info to see where you are, you are hard-pressed to establish a destination. Only with easy to understand, in-depth, and factual data can a local business owner or administration team story a course for future success.

Business owners recognize finest whether an accountant, accountant, or both, is the right solution. Both make vital contributions to an organization, though they are not the same profession. Whereas an accountant can collect and arrange the info needed to support tax prep work, an accountant is better matched to prepare the return itself and really analyze the earnings declaration.

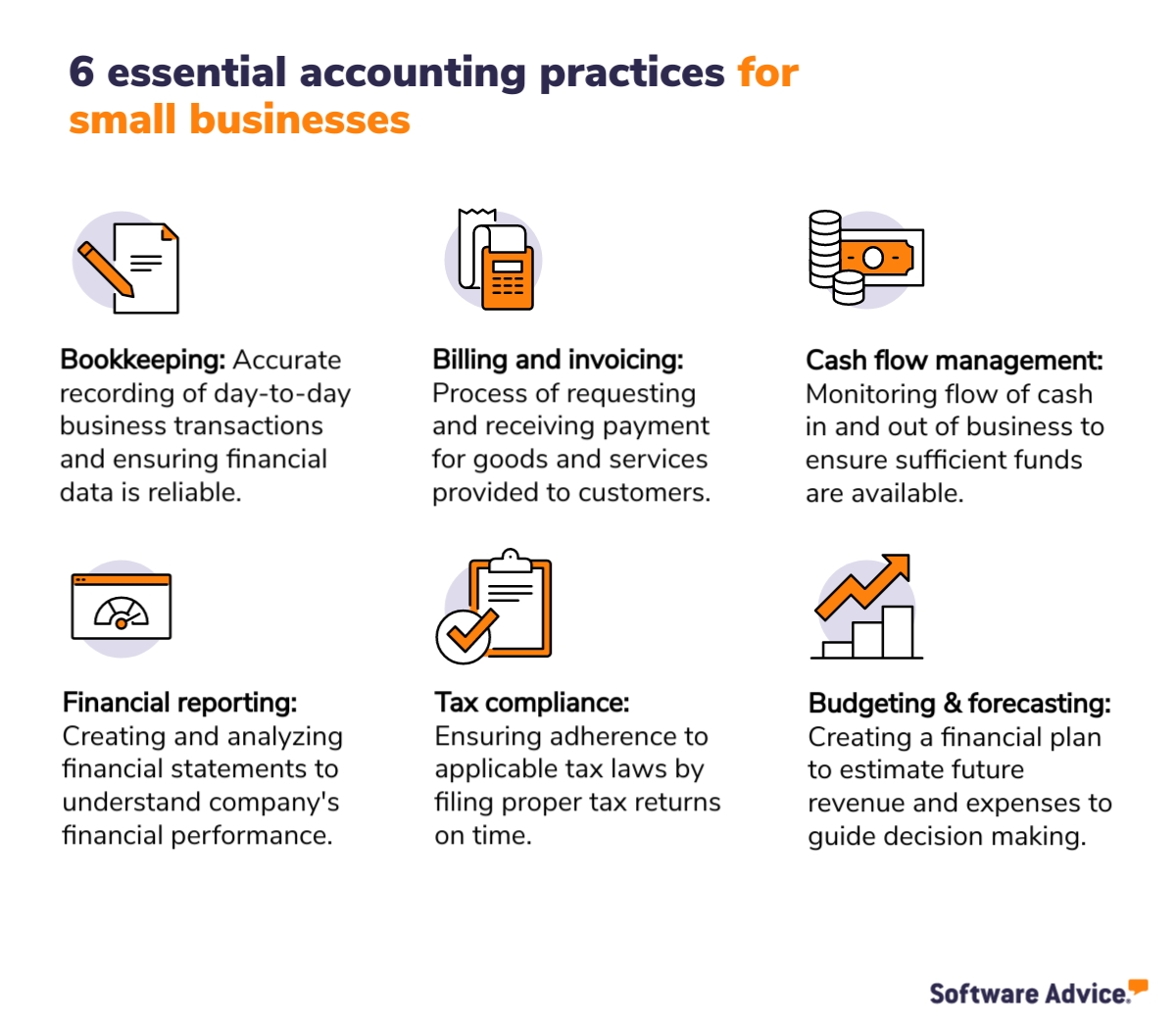

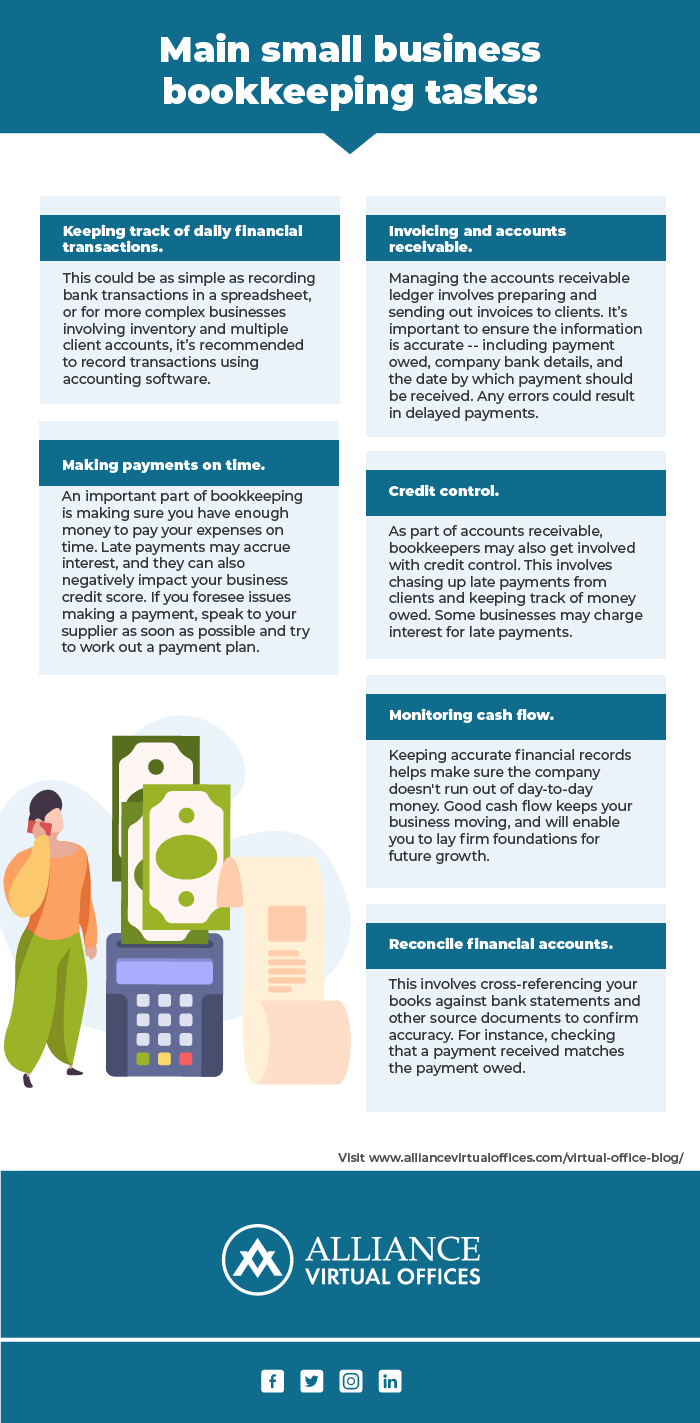

This write-up will dive right into the, including the and how it can profit your company. We'll additionally cover exactly how to obtain started with bookkeeping for a sound financial ground. Bookkeeping involves recording and arranging economic transactions, including sales, acquisitions, settlements, and invoices. It is the process of maintaining clear and concise records so that all economic details is easily available when needed.

By regularly upgrading economic records, accounting assists organizations. This aids in easily r and conserves businesses from the tension of looking for records throughout due dates.

Some Ideas on Stonewell Bookkeeping You Need To Know

They also want to recognize what capacity the company has. These facets can be easily managed with accounting.

By keeping a close eye on monetary documents, companies can set practical goals and track their progression. Normal accounting makes sure that companies remain certified and avoid any type of penalties or lawful concerns.

Single-entry bookkeeping is easy and works ideal for local business with couple of transactions. It involves. This technique can be compared to maintaining a simple checkbook. Nevertheless, it does not track possessions and responsibilities, making it much less detailed contrasted to double-entry accounting. Double-entry bookkeeping, on the various other hand, is much more sophisticated and is usually considered the.

Stonewell Bookkeeping for Beginners

This can be daily, weekly, or monthly, depending on your organization's dimension and the quantity of deals. Don't think twice to seek assistance from an accounting professional or bookkeeper if you find managing your economic documents testing. If you are searching for a cost-free walkthrough with the Bookkeeping Service by KPI, call us today.